Understanding Real Estate Investment Types

Real estate is a term that refers to properties like land and buildings. People invest in real estate for various reasons, such as making money or owning a piece of property. There are different types of real estate that people can invest in, each with its own benefits and drawbacks.

What is Real Estate?

Real estate includes things like land and buildings. When you own real estate, you have a piece of property that can increase in value over time. It's like owning a piece of the world!

Why Invest in Real Estate?

Investing in real estate can be a smart way to make money. When you own property, you can rent it out to others and earn rental income. Plus, as the property value goes up, you can sell it for a profit. It's like having your own money-making machine!

"Real estate investment comes in many forms, but understanding the different types is key to a successful portfolio".

Understanding Land Investments

Investing in land can be a lucrative opportunity for many individuals. Land investment refers to the purchase of raw, undeveloped land with the intention of holding onto it for potential future appreciation. Let's delve deeper into what land investments entail and why they can be a smart financial move.

What is Land Investment?

Land investment involves buying parcels of land with the expectation that their value will increase over time. Unlike residential or commercial properties, land investments do not generate immediate rental income. Instead, investors count on the land appreciating in value as demand for land in a particular area grows.

Benefits of Land Investment

One of the key advantages of land investment is its potential for significant appreciation. As population increases and urban areas expand, the demand for land also rises, leading to higher land prices. Additionally, land investments typically require less maintenance compared to developed properties, making them relatively low-maintenance assets.

Drawbacks of Land Investment

While land investments can be profitable, they also come with certain risks. One of the main drawbacks is the lack of immediate income. Unlike rental properties that generate regular cash flow, land investments may require a longer holding period before seeing substantial returns. Furthermore, factors such as zoning regulations, environmental issues, and market fluctuations can impact the value of land.

Also Read - Make Smart Investment Pros and Cons of 1 bhk and 2 bhk

Residential Real Estate Investments

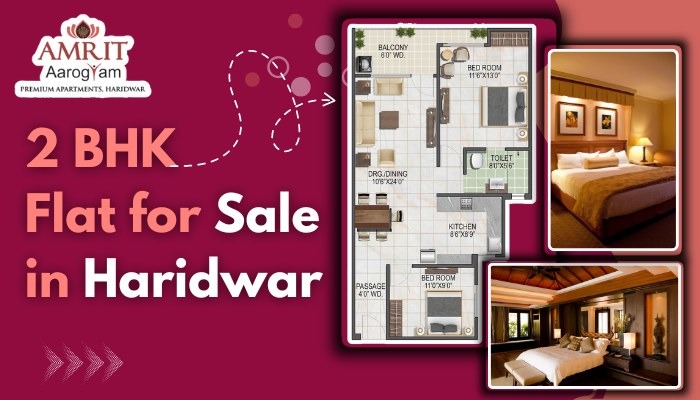

In this section, we will delve into residential real estate investments, which include houses, apartments, luxurious flats and other living spaces where people reside.

What is Residential Real Estate?

Residential real estate refers to properties that are used for living purposes. This can include single-family homes, multi-family buildings, condominiums, and townhouses. People can buy these residential properties to live in themselves or as an investment to rent out to others.

Benefits of Residential Real Estate

Investing in residential real estate can offer several advantages. One of the main benefits is the potential for rental income. By renting out a property, investors can earn a regular stream of income. Additionally, residential properties have the potential to appreciate in value over time, allowing investors to build equity and wealth.

Drawbacks of Residential Real Estate

While there are benefits to investing in residential real estate, there are also drawbacks to consider. Owning and managing rental properties can come with challenges such as finding and retaining tenants, dealing with maintenance and repairs, and handling unexpected expenses. In addition, the real estate market can be unpredictable, leading to fluctuations in property values.

Also Read - New Residential Projects in Haridwar

Commercial Real Estate Investments

In the world of real estate investments, commercial properties play a significant role. Commercial real estate refers to properties that are used for business purposes, such as office buildings, shopping malls, hotels, and retail stores. These properties are designed to generate income through leasing or renting space to businesses.

What is Commercial Real Estate?

Commercial real estate consists of buildings and land that are used for commercial activities. This includes properties like office buildings where companies conduct their operations, shopping centers where retail stores are located, and hotels that provide accommodation services to guests. The primary purpose of commercial real estate is to generate revenue through rental income or capital appreciation.

Benefits of Commercial Real Estate

Investing in commercial real estate can offer several advantages. One of the main benefits is the potential for higher returns compared to residential properties. Commercial leases are typically longer and tenants are often businesses with stable income streams, which can provide a steady cash flow for investors. Additionally, commercial properties are valued based on their income potential, allowing investors to increase the property's value by enhancing its profitability.

Drawbacks of Commercial Real Estate

While commercial real estate can be a lucrative investment, there are also some risks and drawbacks to consider. Commercial properties often require more maintenance and management compared to residential properties. Finding and retaining tenants can be more challenging, especially during economic downturns when businesses may struggle. Additionally, commercial real estate investments typically require a larger initial capital investment, making it less accessible to beginner investors.

Industrial Real Estate Investments

Industrial real estate refers to properties that are used for industrial purposes, such as manufacturing plants, factories, warehouses, and distribution centers. These properties are essential for businesses that need space to produce goods, store inventory, and manage their operations.

Benefits of Industrial Real Estate

Investing in industrial real estate can be a lucrative opportunity for investors. These properties often generate stable rental income from long-term tenants, providing a reliable revenue stream. Additionally, industrial properties tend to have longer lease terms, reducing the risk of vacancies and ensuring consistent cash flow. Moreover, industrial real estate can appreciate in value over time, offering the potential for capital appreciation.

Drawbacks of Industrial Real Estate

While industrial real estate investments have their advantages, there are also potential risks to consider. Market fluctuations and economic downturns can impact demand for industrial properties, leading to vacancies and lower rental rates. Additionally, maintaining and managing industrial properties can require significant capital investment for repairs, upgrades, and tenant improvements. Furthermore, changes in technology and industry trends can impact the suitability of industrial properties for certain businesses, affecting their long-term viability.

Conclusion and Summary

In this blog post, we delved into the fascinating world of real estate investments. We explored the different types of real estate, including land, residential, commercial, and industrial properties. Each type offers unique opportunities and challenges for investors looking to grow their wealth.

Key Points Recap

Land investments can be a solid choice for long-term growth, with the potential for increased value over time. However, they may come with challenges such as maintenance costs and zoning restrictions.

Residential real estate, like houses and apartments, can provide a steady income stream through rental payments. On the flip side, owners may face issues like property damage and tenant turnover.

Commercial real estate, such as office buildings and malls, offers the chance for high returns, especially in bustling business districts. Yet, investors should be aware of risks like economic downturns and vacancies.

Industrial real estate, like factories and warehouses, can be a lucrative investment due to high demand for manufacturing and storage spaces. However, owners need to consider factors such as environmental regulations and market fluctuations.

By understanding the benefits and drawbacks of each type of real estate investment, investors can make informed decisions to grow their portfolios and achieve financial success.

Frequently Asked Questions (FAQs)

What is the safest type of real estate investment?

When it comes to real estate investments, the safest type is often considered to be residential real estate. This is because people will always need homes to live in, so the demand for residential properties tends to remain stable even during economic fluctuations. Additionally, rental income from residential properties can provide a steady source of revenue for investors.

How much money do I need to start investing in real estate?

The amount of money needed to start investing in real estate can vary depending on the type of investment and the location of the property. Generally, you will need enough funds for a down payment on a property, closing costs, and any renovations or repairs that may be required. It is advisable to consult with a financial advisor to determine the specific financial requirements for your real estate investment goals.

Can kids invest in real estate?

While kids may not be able to directly invest in real estate due to legal restrictions, they can still learn about real estate investments at a young age. Parents can involve their children in discussions about real estate, take them to property viewings, or even set up a mock investment portfolio to help them understand the basics of investing. Learning about real estate at a young age can help kids develop valuable financial literacy skills for the future.